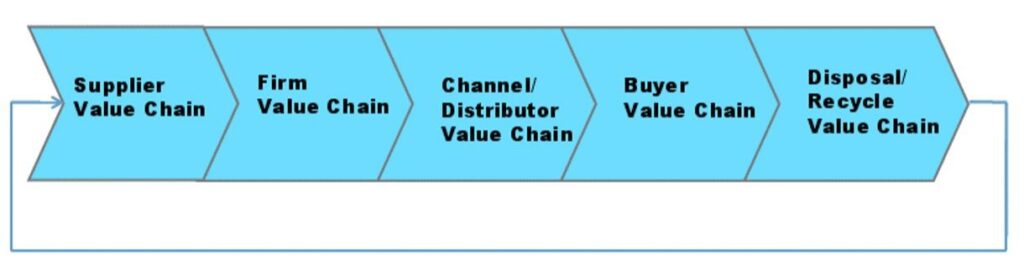

The environment and industry in which any firm operates is a crucial element in determining the market’s attractiveness in terms of present and future demand, ease of doing business, as well as the level of competition. In this sense, it is the environment and industry in which the firm operates that will in turn influence and determine its strategy in terms of the market segments to serve, services and products to offer, activities such as production, marketing, sales, and post-sales service, and the most effective method to do it. Within a firm’s value chain, the term “value” is used to indicate that it is the set of activities mentioned above that deliver some useful good or service to customers at a price that they are willing to pay, given the perceived or actual benefit of this good or service. And then this value must be delivered in a most cost-effective way to ensure profitability. This larger environment in which the firm is seen to operate is many times termed as the ‘value system’ which essentially is the ‘industry value chain’ as against the firm’s “value chain.” The firm value chain becomes a part of the larger industry value chain as per following figure.

The Value Chain within the Air Transportation Industry In this article, we will explore the value chain for the air transportation industry and how all the players (11 key players) in the chain create value for customers, their competitiveness and profit margins. The following diagram gives a snapshot of all the key players in the industry value chain. 1. Aircraft Manufacturers This segment in the value chain is rich in knowledge, research and development along with engine and component manufacturing. The launch of a new aircraft platform is a huge financial undertaking. To put this in perspective the design, certification, and production cycle for the Boeing 787 cost approximately $32 Billion USD. This outpaces development of any other product and is not within the scope of regular investors. Currently Boeing and Airbus have a duopoly in the industry and have been recording an average of 11% profit margins in the past few years. 2. Engine Manufacturers This segment shares many similarities with the previous segment. Each project is a huge undertaking and has associated risks, but they have to be carried out to keep the company at the leading edge of the curve. There are three dominant players in this market: Pratt & Whitney, Rolls Royce, and General Electric. The average profit margins are above 20% in this sector 3. Component Manufacturers Components in the aircraft are all designed to perform a specific job, such as, avionics, breaks, wheels, navigational computers, electrical generators, etc. There are various players in each area of component manufacturing, but as an example if we look at avionics, which is one of the most critical and expensive areas, we will find three main players: Honeywell, Rockwell Collins, and Thales. These players’ average profit margins are above 15%. 4. Lessors Airlines have typically two options: either buy an aircraft or lease it. When leasing, airlines can dry lease, which involves renting the aircraft from a lessor and taking care of maintenance and other activities involved in the operations of the aircraft. This is quite a capital-intensive undertaking, so the dominant players are AerCap and GECAS. AerCap has a portfolio of more then $31 billion in aircraft and net profits of above 20%. 5. Maintenance, Repair and Overhaul (MRO) This segment of the value chain is crowded with players. Initially, airlines used to undertake their own maintenance activities, but the recent trend has been to outsource so that airlines can focus on their core business. Even with this there are certain areas of maintenance that airlines still keep in-house. Profit margins in the MRO sector are typically between 5-10%. 6. Air Navigation Service (ANS) Providers Air navigation services are usually provided by state-owned entities and in some cases private entities. Each country provides ANS by employing radars, air traffic control facilities, and skilled professionals to provide safe passage to flights. ANS charges for the consumer are considered levies or fees, as they are not based on market rules but rather the political and economical situation of each country. 7. Airports Airport ownership is quite varied around the world, with some owned by states, or local municipalities, or by private institutions. Airports by design are a natural monopoly. That is to say, if an airline plans to serve a city, generally it has no other choice than to use the nearest airport that offers all the required infrastructure and facilities. Earlier in history, the main pillars for airport revenue were aeronautical charges, but most forward-looking airports are looking at non-aeronautical and non-aviation revenue streams. Airport profit margins are between 20-40%, even though there are various regulations that might impact the profitability of the airport. 8. Handling Companies Handling companies take care of the aircraft, checking-in and boarding of the passengers, loading and off-loading of cargo and baggage, cleaning of aircraft and cabins, and more. The handling companies are both labour- and capital-intensive and because they need authorisation from airport to operate, entrance cost is a major factor for them. Average handling companies’ profit margins are from 10-11%. 9. Fuel Companies This segment is pretty much oligopolistic in nature and is in line with the competitive landscape of handling companies. These also need authorisations from the airport to operate and their profit margins are between 10-11%. 10. Travel Agencies and Global Distribution System Providers Just like any other industry, distribution is key for suppliers to sell their products. Travel agencies, due to the explosion of internet sales, have adapted their business model to offer bundled products and services, travel experiences etc. online sales portals like Expedia, Opodo, and others have been quite successful, and their margins have been in the range of 12%. The GDS segment has been consolidating for some time and the sector has a duopoly with Sabre and Amadeus, and the margins are in the range of 20-30%. 11. Airlines Airlines are the most critical segment to the whole air transportation value chain. Airlines are the starting point, driver, and enabler of this whole economic cycle. Unfortunately, when you look at the past 10 years of airline margins, they are a meager 2%. The following graph depicts the profits margins for each player in the value chain. The airlines are the only group that falls below the average profit margin line

Overall, the profit margins in the air transportation value chain are very impressive. As previously mentioned, it is unfortunate that airlines see such a small return on investment. Further investigation could be conducted on increasing the profit margin for this important player. References Loddo, A. (2018). Airline Management - A Different View. Rajagopalan, G. (2015, November 17). Industry Value Chain: Understand its Importance and Application to the Mining Industry. Retrieved from http://flevy.com/blog/industry-value-chain-understand-its-importance-and-application-to-the-mining-industry/